This blog is part of InfoDesk’s latest series which explores the state of the life science supply chain in light of COVID-19. You can read our other blogs here or download the latest InfoGraphic here.

As the COVID-19 pandemic evolves, the life sciences industry is seeking a pathway back to the normalcy of uninterrupted supply chains and efficient stakeholder interactions. Our fourth blog in this series looks at how the consumer-facing link of the life science supply chain, the Go-to-Market capabilities, have been affected, particularly, market access and launching activities. Causes of the disruption of these activities include difficulties with disseminating important information to healthcare providers about existing or new products within an environment of social distancing as well as patients experiencing challenges in interactions with healthcare practitioners due to issues such as transportation hindrances or limited office hours (click here to learn more about patient access). Indeed, the human interaction problems are affecting all stakeholders involved; healthcare practitioners, pharmacists, medical educators, patients and sales representatives. Across the industry, life sciences companies and vendors are responding in various ways to the challenges of a disrupted go-to-market supply chain by enacting new business communication strategies and digital tools or even altering their planned market entry timelines.

Supply Chain Challenges in the Go-to-Market

Go-to-Market is at the tail end of the life sciences supply chain, and a big part of this segment involves communication with healthcare practitioners and patients. With the various COVID-19 related social distancing mandates, there has been less access to healthcare offices and some life sciences company stakeholders have not been able to efficiently interact with clinicians or pharmacists. Without such interactions as physician detailing, medical education and conference presentations, a given healthcare provider may simply not be aware of a product enough to feel comfortable in prescribing and/or using it. Therefore, the final step in the delivery of a product may never come into fruition. In effect, the supply chain “halts” at the point where interpersonal communication is interrupted – whether it is a sales representative who cannot alert a physician of a new indication for a drug or that the routine drop-off of pharmaceutical samples is stopped.

The performance of existing drugs and devices sales during the pandemic has been up and down, largely depending on the therapeutic area. A particular supply chain challenge for these existing products is the decrease of in-person physician visits as well as decreased pharmacist communication with sales force members due to reduced hours at such facilities, transportation restrictions or the need to stay six feet apart. Fewer engagements with healthcare practitioners can mean that drug and device sales can decrease or that a healthcare practitioner may not be alerted to important information from the life science company. For example, in an earnings report, Paratek Pharmaceuticals noted that because of the pandemic, many hospitals made newly enacted rules that did not allow non-patients into the facilities and therefore their sales force and clinical educators could not properly educate physicians on the company’s antibiotic drug NUZYRA.

Likewise, new drugs entering the market may also face supply chain challenges at the juncture where life sciences stakeholders interact with healthcare staff and/or patients. If poor communication occurs between clinician and patient, or clinician and life sciences company, a potentially suitable drug or device may never be prescribed for the patient, leaving the product on the shelf at a distribution center. Even if a company decides to delay a launch because of these communications and market challenges, they may lose valuable patent exclusivity days as well as having to re-evaluate anticipated market share.

Numerous companies have already announced shifted launch dates for their newly approved drugs in recent months. Neurocrine Biosciences reported that they are delaying the launch of their Parkinson’s disease drug Ongentys. CEO Kevin Gorman was blunt with his comments about the decision:

“[Ongentys] is ready to go to market but hasn’t yet launched… This isn’t an environment any company wants to launch a drug into.”

GlobalData, a life sciences analytics company, also examines drug launch delays due to COVID-19 and an analyst stated: “…It will be hard for most companies to meet their drug’s commercial launch expectations under these circumstances.” Particularly for Ongentys, GlobalData predicts that if the drug is launched in late 2020, initial sales uptake may be slow. The particular reasons that Neurocrine Biosciences may be considering a delayed launch are also reviewed by GlobalData. Since the drug is not considered an “emergency” medication, neurologists may not feel compelled to prescribe this new drug within an environment of COVID-19 when trusted marketed drugs already exist. Another particular issue of concern is that Parkinson’s patients tend to be elderly, so in-person clinic visits may be rarer and diagnosing the disease may have challenges in a virtual environment. Finally, they contend that e-detailing tactics may not be comprehensive enough to fully educate healthcare staff about new drugs, since traditionally a robust array of marketing, educational materials, and interactions are needed for such therapies.

Bristol-Myers Squibb was very in-depth in their explanation regarding how the pandemic is affecting many aspects of their drug launches. They overtly mentioned how challenging it would be for the field force members to do normal detailing procedures with healthcare professionals, and accordingly, this limitation might make sales difficult. In a Bristol-Myers Squibb financial statement, they stated,

“We have also delayed the launch of certain newly approved products and may delay future expected launches as well. It is possible that these actions could have a greater negative impact on our business than currently expected. It is also possible that there could be a longer-lasting shift in interactions between field personnel and health care professionals that we have not anticipated, which could have a negative impact on our business and results of operations.”

Consulting firm ZS Associates analyzed Bristol-Myers Squibb’s decision and principal Pratap Khedkar explained,

“If a rep can’t go there, and a physician doesn’t read emails thoroughly, the physician isn’t going to be aware [of the new product]… The launch suffers a lot. That back-and-forth, the learning that happens in the first six months, is not going to happen.”

Even device makers are noting potential launch plan changes, Merit Medical Systems, for example, has mentioned that assorted new product launches will be delayed because of the pandemic. In fact, the one product they did decide to launch in April 2020 was a nasopharyngeal swab and transport vial that could assist with COVID-19-associated biological samples. A wider problem for the device/diagnostic segment of the life sciences industry is that various elective procedures were postponed during the pandemic, so a new product going into such a market may likely face sales challenges. Examples of this include Intersect ENT reporting Q1 2020 earnings losses and Owens & Minor warning that they may experience reduced second quarter 2020 earnings. Both companies overtly cited the suspension of elective procedures as the reason for their reduced sales.

Analytics company IQVIA reported that the total number of prescriptions declined early during the pandemic in comparison to the first few months of 2020. Additionally, they reported that new-to-brand prescriptions only rebounded by late April. Even cancer screenings were delayed during the pandemic, according to EPIC Health Research Network. So, in light of an environment of reduced drug sales and physician visits coupled with the lack of normal communication channels, some life sciences companies are quite concerned regarding any potential product launch.

Although it may be understandable that a life science company might want to delay new drugs coming into the market, there may be unintended consequences even to this action. For example, if a multitude of companies within the same therapeutic area delay launches until late 2020, a tremendous backlog may be unleashed, over-saturating the market and possibly also causing supply chain disruption due to the vast volume of products. Furthermore, within a broader macroeconomic context, if a long-term pandemic disruption takes place it may mean that more numbers of uninsured and unemployed people cannot afford drugs, even within the latter part of 2020. Indeed, it seems that challenges abound for either on-time or delayed launching scenarios for life sciences firms.

How the Industry is Responding

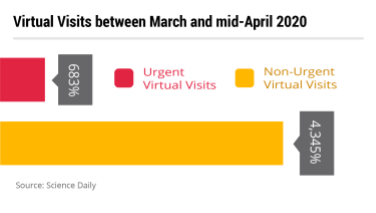

Various companies are trying to address this “lack of human interaction” kink in the supply chain by using digital tactics in order to ensure high quality and comprehensive healthcare communication among all involved stakeholders. Telemedicine and e-detailing are two such technologies that are increasingly being used. A recent study by The Commonwealth Fund reported statistics about telemedicine visits of 50,000 providers during the pandemic, and they stated that these remote visits vastly increased between March and late April (at the same time that physical clinic visits were decreasing).

When NYU Langone analyzed their telehealth activities during the outbreak, they found that between March and mid-April, urgent virtual visits increased 683% and non-urgent virtual visits increased an “unprecedented” 4,345%.

Telemedicine is even being used for clinical trials now, helping to keep studies going in light of patients’ concerns about physically visiting clinics. In fact, even remote consent protocols are being initiated through virtual technologies. Below are some of the digital communication strategies that some companies have tried during the pandemic.

- Novo Nordisk CFO Karsten Knudsen said in response to how the company is navigating through COVID-19 “…I’d say the technology and e-detailing is clearly getting turbocharged in terms of virtual interactions with our stakeholders from now on…”

- In an earnings report transcript, Chugai Pharmaceutical Co. provided the following statement: “…If physicians require, we can e-mail them and offer web-based meetings. We will also consider leveraging e-detailing and utilizing paid media so that we can combine multiple avenues going forward.”

- For Teva Pharmaceutical Industries, CEO Kare Schultz said, “In the process of keeping our commercial operation going, we have been seeing a lot of digital instruments being implemented. We have been instrumental in doing a lot of e-detailing, different new ways of communication in order to keep the sales forward effective.”

- Acadia Pharmaceuticals indicated that their strategy was to move their promotional and educational materials to online portals so that clinical staff could access them. They also enabled physicians to prescribe NUPLAZID by using online tools. Additionally, they guaranteed home delivery of NUPLAZID instead of the patient having to pick it up at pharmacies. Sales actually went up for the drug in the first quarter of 2020, and the company credits “strong commercial execution.” In fact, CEO Steve Davis stated that the pandemic spurred them to offer a “best in class virtual education and engagement” platform.

So, are any life sciences companies actually launching any non-COVID-19 products into this environment? Indeed, Intra-Cellular Therapies virtually launched their new schizophrenia drug CAPLYTA during the thick of the outbreak in March 2020. Even the initial launch meeting was 100% remote. All the sales representatives were equipped with virtual detailing technology, including sampling capability. The company maintained a remote peer-to-peer educational platform as well as offered digital outreach programs. Intra-Cellular Therapies CEO Dr. Sharon Mates said of the effort:

“In the midst of these unprecedented times we are proud of the agile adaptation of our organization to successfully execute a virtual launch of CAPLYTA…”

Another company that executed a successful virtual launch recently was Biohaven Pharmaceuticals. They also debuted their migraine drug NURTEC ODT in March 2020. They presented 25 scientific abstracts for their newly launched drug at the virtual American Academy of Neuroscience meeting in May 2020. The company also initiated an innovative collaboration with telemedicine provider Cove, whereby the platform allowed migraine patients to be evaluated by an independent healthcare provider and potentially be prescribed NURTEC ODT. Dr. Vlad Coric, CEO, said of the launch,

“Our commercial team demonstrated that we can deliver important medicines like NURTEC ODT to patients even under the most challenging situations…”

Although digital communication initiatives among physicians, patients, sales representatives and medical educators are generally being positively touted in the media, there are some lingering problems from a statistical standpoint. Regarding the virtual communication tactics between life sciences firms and clinicians, ZS Associates finds that only 9.6% of physicians engage in digital interaction with the sales representatives. Additionally, a survey of medical specialists from Spherix Global Insights found that some physicians experienced challenges with implementing telemedicine and were also concerned about the reimbursement aspects of the technology. In regards to how physicians feel about pharmaceutical companies’ digital efforts, the survey also found that only 22% of nephrologists stated that the pharmaceutical industry is doing enough in terms of support and communication during the pandemic time period. Overall, it appears that life sciences companies may face market challenges even with the usage of digital tools, so the road forward may include continuous evaluation of communications tactics in order to choose the most successful strategies.

Analysts’ Insights and Mitigating Strategies

Various experts and vendors within the life sciences industry have provided their insights on this human interaction issue within the supply chain as well as analysis of market conditions that may affect products going into the market. Ipsos offers advisory on the issues to consider when launching a new drug product. In their impact report, they state that pharmaceutical companies should consider how frequently sales representatives will visit with healthcare practitioners, since many healthcare workers are seeing fewer patients than normal and lately practitioners have been stating that they don’t even want to write prescriptions for new drugs. Additionally, Ipsos reports that over a quarter of healthcare practitioners are not prescribing drugs that affect the immune system. These data points are all important issues to consider when deciding whether to launch a drug at this time.

Eye on FDA thoroughly covered the issue of getting new drugs to the market during the pandemic. They suggested the following market conditions and communication issues to consider:

- Patients are concerned about the safety of physical physician visits.

- Unemployment may lead to a loss of health insurance.

- Both physicians and patients may be concerned with being prescribed a new therapy since that action usually needs a follow-up clinic visit.

- Physicians may be busy with other pandemic-related interactions and may have reduced normal practice hours.

- There is a learning curve for field force members and clinicians in mastering virtual communication technology.

One real-world example of bringing a drug to the market during the pandemic, in which best practices were shared, comes from an article profiling the chief commercial officer Brendan Delaney of Immunomedics. He gave an interview in which he explained the company’s launch of their new cancer drug Trodelvy in the first quarter of 2020. The interview is within an article that is aptly entitled: “How to launch a drug in a pandemic…” Delaney actually stated that the company never even considered delaying the launch of the newly approved drug. Regarding the challenges of the virtual launch, he specifically highlighted the human communication part of the process and said “…You can’t replace face-to-face interactions” with medical professionals. The company fully equipped all their field force members with virtual communications tools and also successfully pre-planned to have enough drug product to be able to distribute them to the new patients. In fact, they had the drug available in the distribution channel just days after regulatory approval. Additional factors that helped the company with the launch included adequate funding, offering a highly differentiated product and having promising clinical data to report.

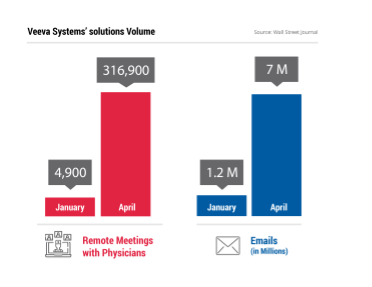

As often is the case, stressful events provide momentum for innovation. Numerous life science vendors have introduced new products and services that assist with communication and market access during the pandemic. Veeva Systems recently launched a remote drug sampling ordering capability for its existing customer management software. This tool allows sales force members to virtually visit a healthcare practitioner and take orders for drug samples within a regulatory compliant manner. The firm also stated that life sciences firms that used the vendor’s communication tools saw interactions increase during the pandemic.

Within April, for example, the companies that used Veeva Systems’ solutions conducted more than 316,900 remote meetings with physicians as well as sent about 7 million emails to them, which was an increase from the volume in January which included 4,900 remote meetings and 1.2 million emails.

Vendors like TI Health are partnering with life sciences companies in order to help them bridge the gap of communication in an environment where medical seminars are canceled and many patients can only see a physician via a telemedicine channel. They specifically cited particular communication tactics that are working in engaging healthcare practitioners. Such vehicles include banner messaging, education and medical newsletters since physicians are in “research mode” because so many medical conferences have been canceled. TI Health stated that the uptick in virtual traffic was “palpable.” In a recent blog on TI Health’s website they concluded:

“Pharmaceutical manufacturers seeking to inform, educate and support the provider as they navigate a new virtual treatment regime will come out on top.”

Conclusion

The life sciences industry is attempting to transcend the vast challenges that the COVID-19 pandemic has wrought. To maintain a solid supply chain within the go-to-market, all stages must efficiently flow, including human communication, or various processes may halt. The ultimate objective is excellence in communication with stakeholders throughout the entire free-flowing supply chain, a goal in which the life science industry is aiming to bring into fruition through effort and innovation.

COMMENTS